Annualizing refers to finding an equivalent annual rate of return which results in the same gross rate of return currently experienced. For instance, if your portfolio grows 60% over four years, this is the equivalent of experiencing 12.5% growth per year.

It may be tempting to take 60% and divide by 4 to get “15% per year.” This is true if your portfolio grows at 15% OF THE ORIGINAL VALUE each year. However, because of compounding, the interest you receive each year experiences growth in addition to the original portfolio.

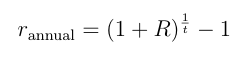

Here is how to annualize: